Read complete terms and conditions for details about balance transfers, rates, fees, extra costs, and rewards benefits.

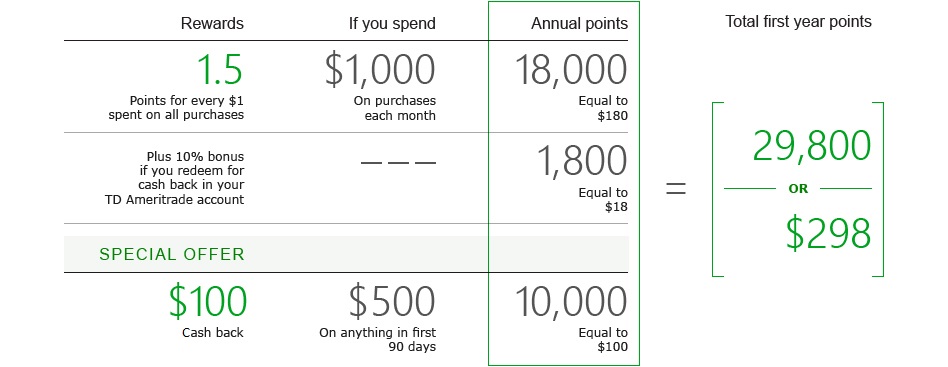

Earn 10,000 bonus points which can be redeemed for $100 cash back when you spend $500 in purchases within 90 days after account opening

1.5% in rewards on purchases – no caps, no limits as long as your credit card account is in good standing

| Variable Annual Percentage Rate (APR) for Purchases | 13.24%, 18.24% or 23.24% based on your creditworthiness |

| APR for Balance Transfers | 13.24%, 18.24% or 23.24% based on your creditworthiness |

| Balance Transfer Fee | $10 or 4% of transfer whichever amount is greater |

| Minimum Interest Charge | $1 |

| APR for Cash Advances | 23.49% |

| Cash Advance Fee | $10 or 5% of advance whichever amount is greater |

| Annual Fee | None |

| Foreign Transaction Fee | 3% of each transaction in U.S. dollars |

| Late Payment | Up to $35 |

Need more information?

Cash | Gift Card | Statement Credits | Merchandise

To earn and redeem points, your account must be open and in good standing.

You earn 1.5% (1.5 points) per dollar spent on all eligible, net retail purchases. Net purchases are defined as new purchases less any credits, returns, and adjustments. Your account must be open and in good standing in order to earn and redeem.

If you redeem your points for a cash back redemption into your eligible TD Ameritrade account you will earn an additional 10% rewards bonus. You must have an eligible TD Ameritrade account, which is open and in good standing, to redeem for a cash back reward and the 10% rewards bonus.

As an example: $10,000 spent in purchases x 1.5% (1.5 points)/per dollar spent in purchases = 15,000 points. 15,000 points is redeemable for a cash back reward of $150, plus the 10% bonus reward equals a cash back reward of $165.

For as long as the account remains open and in good standing, points will not expire and there is no restriction to the number of points that may be earned.

Customer Service is available 24/7, 365 days a year.

Please contact us immediately at and we will cancel your card and send you a new one within 7-10 days. If you have automatic bill payments set up, they will be transferred to your new card. And with Visa's Zero Liability Policy, you will not be liable for unauthorized purchases made online or for signature-based transactions at merchants.